Demand for patent protection continued to grow in 2022, with innovators in China, the United States, Japan, the Republic of Korea and Germany leading in filings under WIPO’s Patent Cooperation Treaty (PCT) which simplifies the process of seeking patent protection in multiple countries.

In 2022, PCT filings rose slightly by 0.3%, totaling 278,100 - the highest number ever recorded in a single year. India (+25.4%) and the Republic of Korea (+6.2%) saw sharp growth in PCT filings.

The overall modest growth rate reflects the challenging economic conditions prevailing in 2022. Notwithstanding these conditions, firms continued to invest in innovation and intellectual property.

Asia remained the dominant source of international patent applications, accounting for 54.7% of the 2022 total, up from 40.3% in 2012.

Demand for design protection saw double-digit growth, with China's 2022 accession to WIPO's international design registration system fueling a surge in international design applications.

In 2022, the number of designs included in international applications under WIPO’s Hague System for the International Registration of Industrial Designs increased by 11.2% to reach 25,028.

Following exceptional growth of 15% in 2021, use of the international trademark system for brand protection in 2022 declined by -6.1%, the largest drop since 2009. The total number of applications filed in 2022 was about 69,000.

The economic disruptions caused by the COVID-19 pandemic in 2021 prompted firms to introduce new goods and services which helped fuel the exceptional growth in international trademark protection. Although lower than in 2021, the total number of applications filed under WIPO’s Madrid System for the International Registration of Trademarks in 2022 was still 8% higher than in 2020.

International IP filings largely held up in 2022. Despite difficult economic conditions and a decline in risk finance, businesses continued to invest in innovation. China’s entry into the Hague System – WIPO’s international register for industrial designs – fueled design applications from China and the rest of the world, showing that multilateral approaches to international cooperation can deliver benefits for everyone.

WIPO Director General Daren Tang

International patent system (Patent Cooperation Treaty – PCT)

Top PCT filers

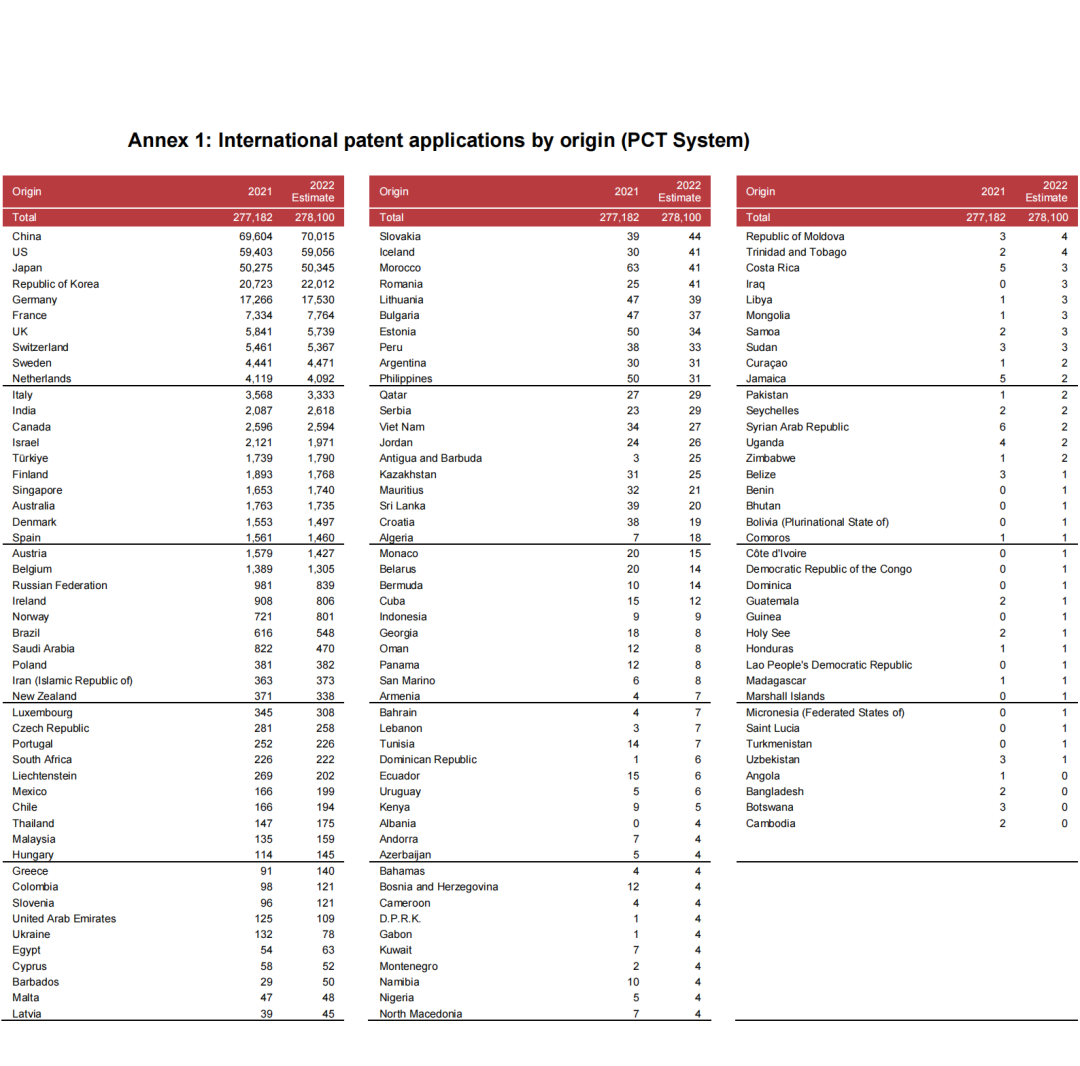

In 2022, China continued to be the top origin of PCT applications filed with 70,015 - a modest growth of 0.6% from the previous year. The US came in second with 59,056 applications, (– 0.6% drop on 2021). Japan followed with 50,345 applications (+0.1%). The Republic of Korea and Germany rounded out the top five, with 22,012 applications and 17,530 applications respectively, both experiencing growth with 6.2% and 1.5% respectively (Annex 1 ).

In addition to the Republic of Korea (+6.2%), several countries within the top 20, such as India (+25.4%), France (+5.9%), saw healthy growth in PCT filings. The number of filings of PCT applications in Asia have been growing faster than in the rest of the world, increasing its overall share from 54.2% in 2021 to 54.7% in 2022.

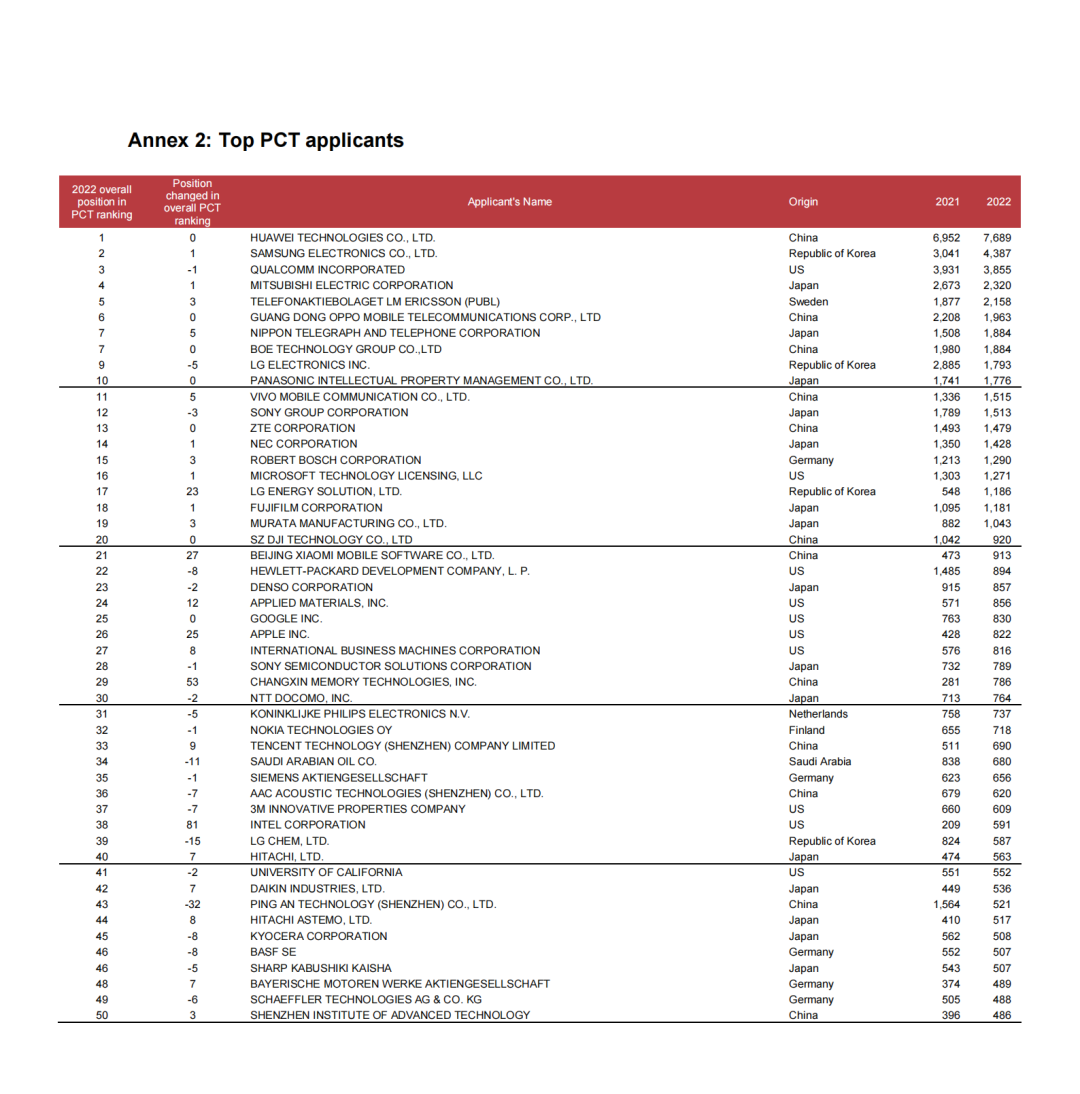

Chinese telecoms giant Huawei Technologies remained by far the top filer with 7,689 published PCT applications in 2022. Samsung Electronics of the Republic of Korea came in second (4,387 applications), followed by Qualcomm of the US (3,855), Mitsubishi Electric of Japan (2,320) and Ericsson of Sweden (2,158) ) (Annex 2).

Samsung Electronics had the fastest growth rate among the top 10 applicants with an increase of 44.3%, which propelled them to the top two spot. The Nippon Telegraph and Telephone Corp. (NTT) also saw sharp growth, moving up five positions to seventh place in 2022 with a growth rate of 24.9%.

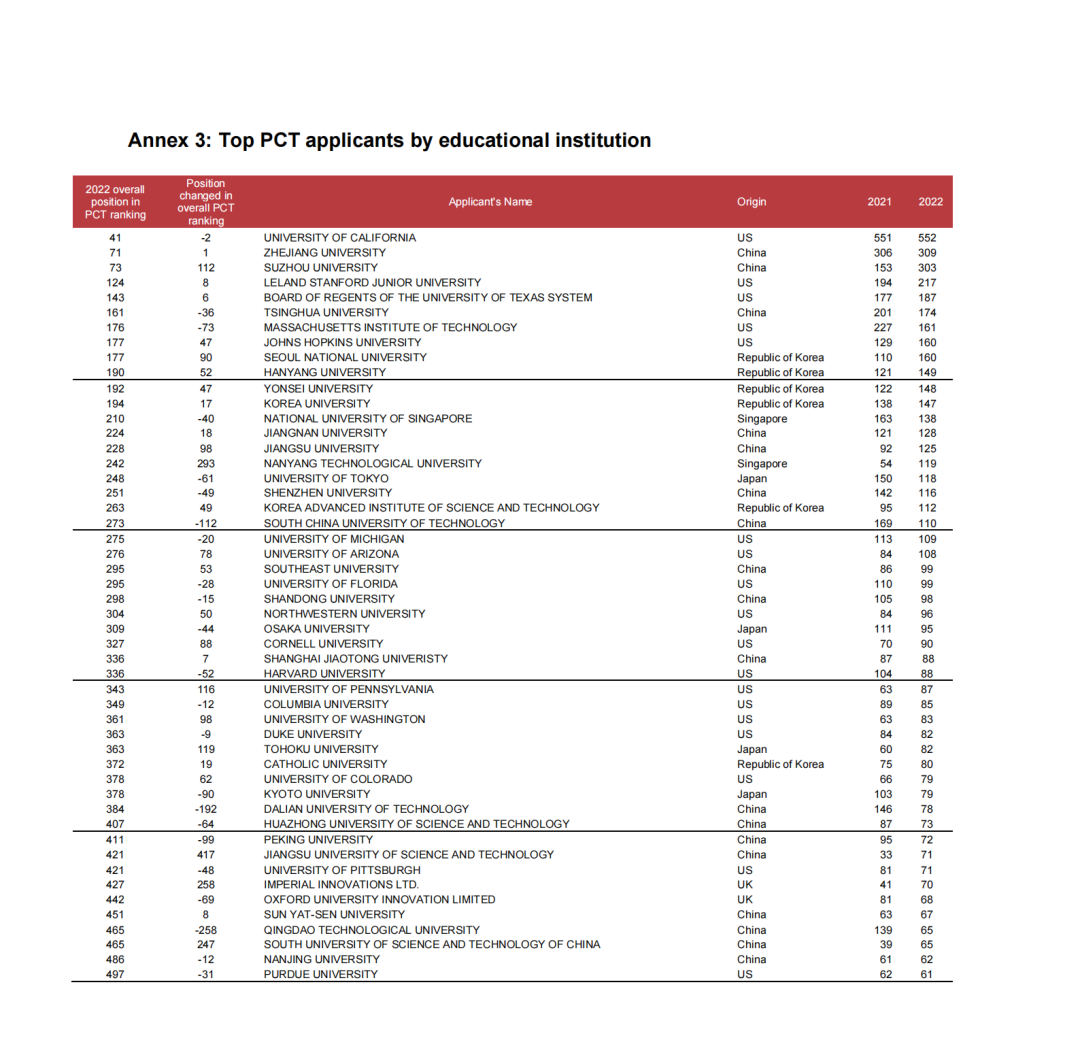

In the education sector, the University of California remained the top applicant with 552 published PCT applications in 2022. Zhejiang University came in second (309 applications) followed by Suzhou University (303), Leland Stanford Junior University (217) and the University of Texas System (187) (Annex 3).

Suzhou University saw the sharpest increase among the top 10 educational institutions, with their number of PCT applications almost doubling from 2021.

Top technologies

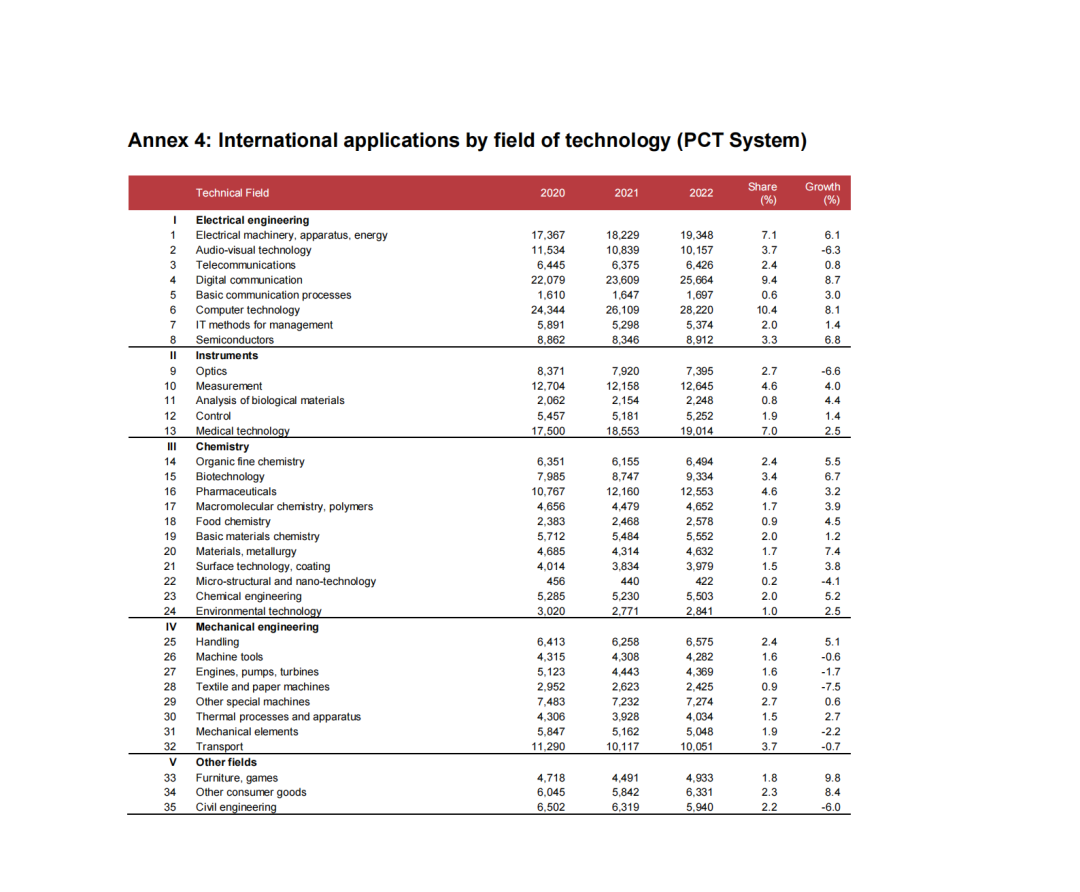

Computer technology accounted for the largest share of published PCT applications at 10.4%, followed by digital communication (9.4%), electrical machinery (7.1%), medical technology (7%) and measurement (4.6%) (Annex 4 ).

Of the top 10 fields of technology, eight saw growth in 2022, with digital communication (+8.7%) and computer technology (+8.1%) seeing the fastest rate of growth, followed by semiconductor (+6.8%), biotechnology (+6.7%) and electrical machinery (+6.1%). After the particularly strong growth in health-related technology fields of last year, digital technology fields returned to the fastest growing fields among PCT applications in 2022.

International trademark system (Madrid System)

Top Madrid filers

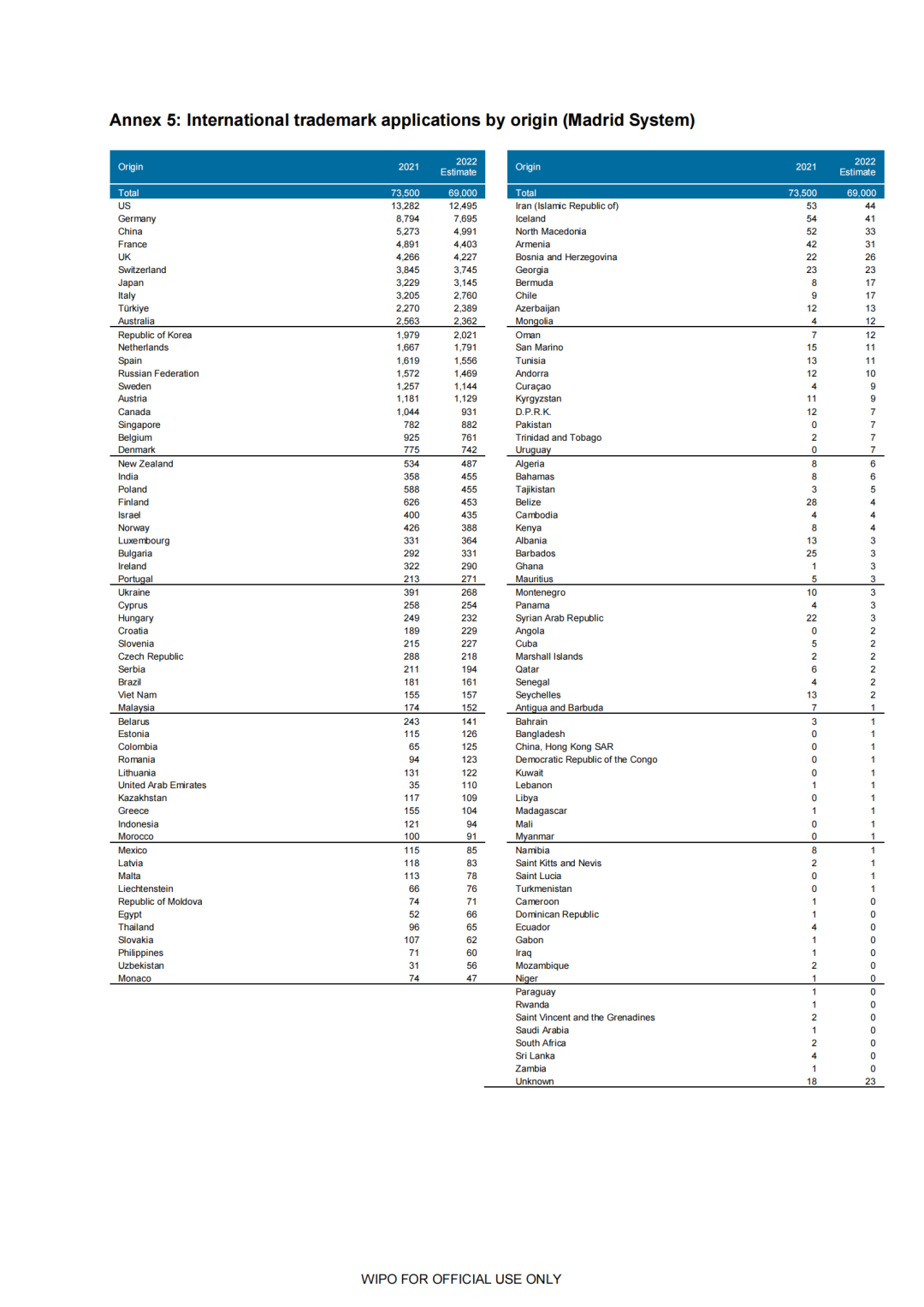

The total number of applications filed under the Madrid System in 2022 reached 69,000. US-based applicants (12,495) filed the largest number of international trademark applications, followed by those located in Germany (7,695), China (4,991), France (4,403) and the United Kingdom (4,227) (Annex 5).

Among the top 15 countries of origin, only three – the Netherlands (+7.4%), the Republic of Korea (+2.1%) and Türkiye (+5.2%) – recorded growth from 2021 to 2022. In contrast, Germany (–12.5%) and Italy (–13.9%) saw the sharpest declines. Despite the one-year decreases for top origins France (–10.0%), the UK (–0.9%) and the US (–5.9%) from 2021 to 2022, their 2022 application numbers were still higher than their 2020 levels by 17.7%, 12.9% and 24.8%, respectively.

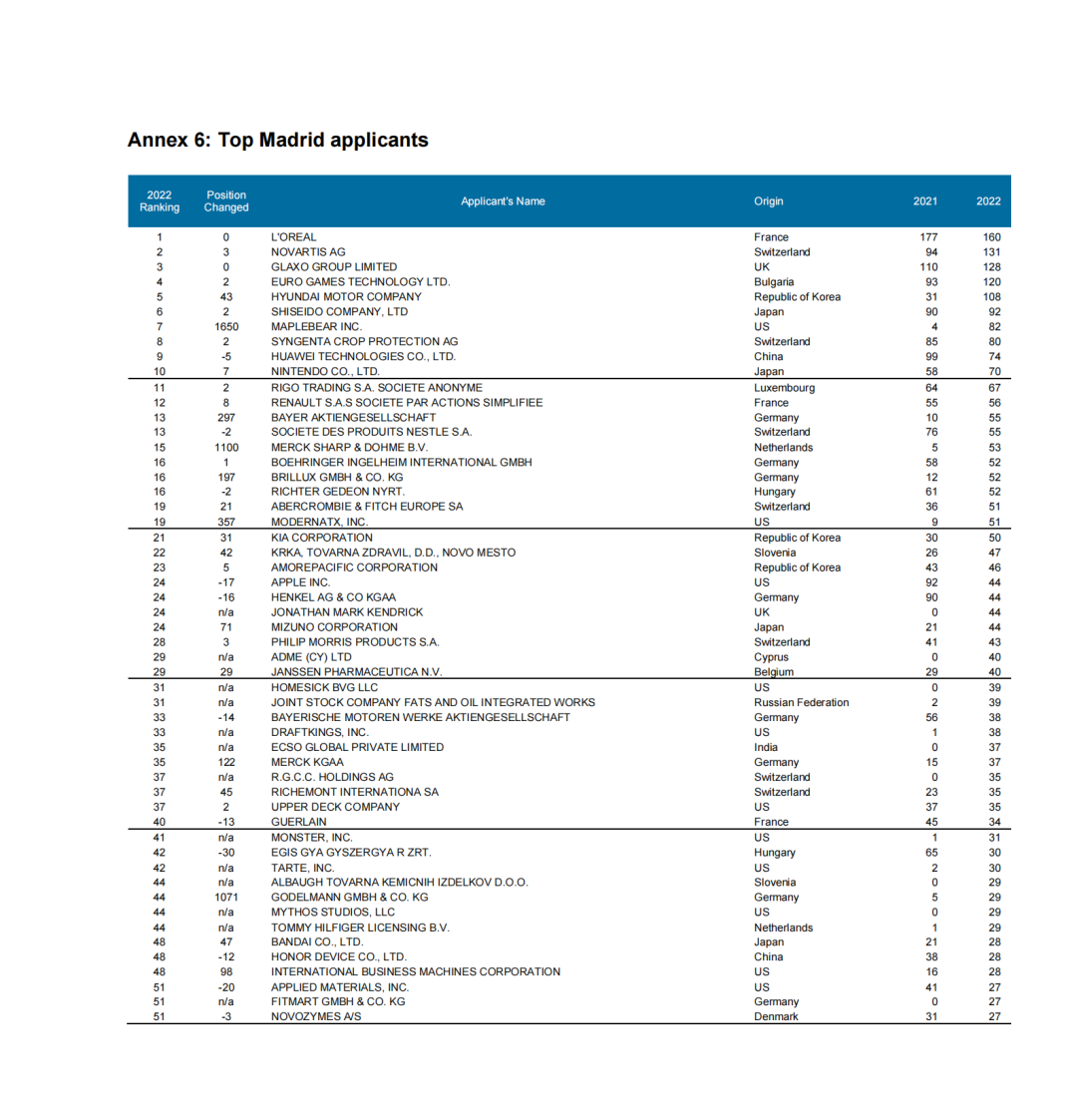

L’Oréal of France, with 160 Madrid applications, remained the top filer for the second year running in 2022. Novartis AG (131) of Switzerland moved up three places to become the second top filer, followed by Glaxo Group of the UK (128), Bulgaria’s Euro Games Technology (120) and Hyundai Motor Company (108) of the Republic of Korea. Hyundai Motor Company filed 77 more applications in 2022 than in 2021, elevating it from 48th position to the 5th largest applicant. Active in online grocery delivery and pick-up, Maplebear Inc. (82) of the US also saw a considerable increase (+78 applications) between 2021 and 2022 filings, elevating it to the top 7th spot (Annex 6).

Top classes

The most specified class in international applications received by WIPO covers computer hardware and software and other electrical or electronic apparatus, accounting for 11.3% of the 2022 total. It was followed by the class covering business services (8.8%) and the one relating to scientific and technological services (8.5%).

Despite an overall decrease in the number of applications filed in 2022 and the total number of classes specified in them, classes among the top 15, such as the class covering financial, banking, insurance and real estate services (+13.9%) and the class that includes services for education, training, entertainment, sporting and cultural activities (+8.3%) saw considerable growth. In contrast, goods classes covering pharmaceuticals (–12.2%), cosmetics (–12.0%) and surgical, medical, dental and veterinary apparatus and instruments (–14.0%) recorded large declines in 2022, after each having posted sizeable increases from 2020 to 2021.

International design system (Hague System)

Top Hague filers

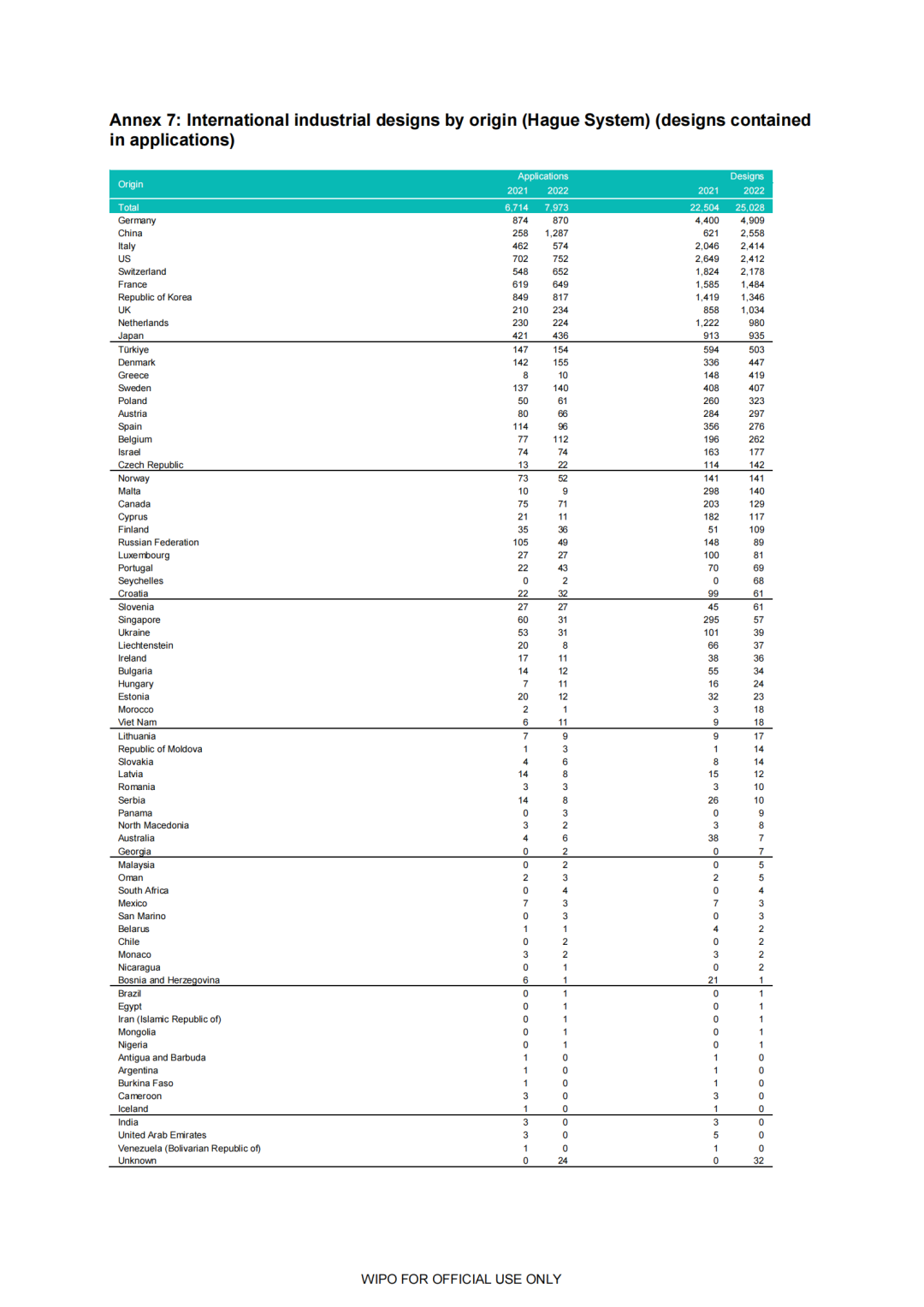

In 2022, the number of designs included in international applications under WIPO's Hague System reached a record to reach 25,028, an increase of 11.2%. Germany remained the top user of the international design system with a 11.6% increase to 4,909 designs (Annex 7).

China, as a new member, sought protection for 2,558 designs, securing second place. Italy, with a growth of 18%, overtook the US to rank third with 2,414 designs, while the US saw a decline of 8.9% to 2,412 designs. Switzerland followed in fifth place with 2,178 designs.

In 2022, four of the top ten countries experienced double-digit growth. The UK had the highest growth rate at 20.5%, closely followed by Switzerland (+19.4%), Italy (+18%), and Germany (+11.6%). The growth rate for China is not applicable as it only joined the Hague System in 2022.

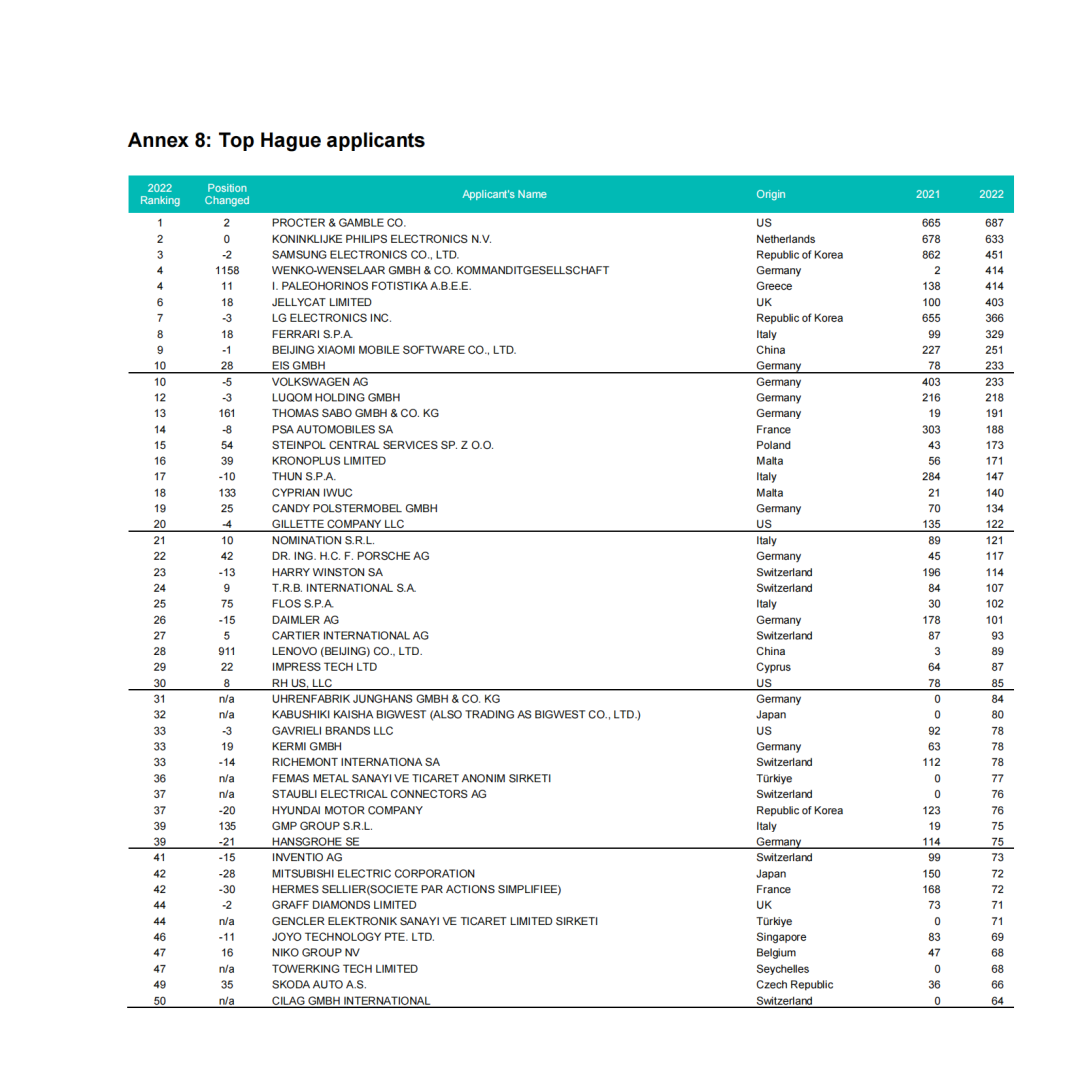

Procter & Gamble, a US-based company, moved into the top filing position with 687 designs in published applications, replacing Samsung Electronics of South Korea (Annex 8).

Philips Electronics from the Netherlands came in second with 633 designs, followed by Samsung Electronics with 451, Wenko-Wenselaar GMBH from Germany with 414, and I. Paleohorinos Fotistika from Greece also with 414 designs.

Wenko-Wenselaar GMBH, Jellycat Limited of the UK, I. Paleohorinos Fotistika, and Ferrari of Italy, all saw substantial increases in the number of designs included in their applications in 2022 compared to 2021, with increases of 412, 303, 276, and 230 designs respectively. On the other hand, Samsung Electronics recorded a decline of 411 designs in 2022 compared to 2021, which led to its drop from the top position to third. Of the top 10 filers, six are located in Europe, two in the Republic of Korea, and one each in China and the US.

Top fields

In 2022, the largest share of total designs was in recording and communication equipment (10.4%), followed by means of transport (9.7%), packages and containers (7.0%), furnishings (6.8%), and fluid distribution equipment, sanitary, heating, ventilation, etc. (6%).

Comment